As foundation models become the new compute substrate, we’re seeing a fascinating—and highly lucrative—market inefficiency emerging: token arbitrage.

Right now, large language models (LLMs) like GPT-4 and Claude are priced as commodities: $0.03 per 1k tokens here, $0.02 per 1k tokens there. But tokens aren’t commodities, not really. Their value shifts dramatically based on the specific task, context, or industry.

This isn’t just a minor pricing anomaly; it’s a wide-open opportunity.

Not All Tokens are Created Equal

A token used in a general Q&A prompt might be worth fractions of a cent. But what about tokens that summarize sensitive legal contracts, triage urgent medical data, or analyze proprietary financial models? The value skyrockets. Users willingly pay significant premiums—sometimes 100x or more—because the cost of error or inefficiency is vastly higher.

What we have today is akin to the early days of AWS versus on-prem infrastructure. In the early 2010s, AWS dramatically lowered the cost of compute and storage, and many early players built successful businesses by reselling AWS infrastructure—packaging EC2 or S3 into vertical-specific solutions and charging meaningful premiums. We’re seeing the same dynamic now with foundation models. GPT-4 and Claude are priced uniformly per token, regardless of how they’re used, but tokens applied to specific, high-value use cases can command outsized premiums. That pricing gap creates a huge arbitrage opportunity.

How to Play the Token Arbitrage Game

- Identify high-value niches: Find industries or workflows where users value accuracy, speed, or compliance above raw token costs—think finance, healthcare, law, or high-stakes decision-making.

- Optimize workflows: Build tailored prompting strategies and workflow orchestration that squeeze maximum utility from minimal tokens. More effective prompts = fewer tokens needed = higher margins.

- Repackage and price for value, not cost: Sell based on outcomes—”medical summarization and diagnostics” or “recommendations for how to invest your 401k given the risk of tariffs”—rather than generic token counts. Users don’t care about tokens; they care about solutions.

- Verticalize aggressively: The first mover who deeply understands an industry’s needs and embeds genuine domain knowledge into their token use-cases builds defensibility that generic competitors can’t match.

Early Winners are Already Minting Money

We’re already seeing smart startups leverage this strategy:

- Legal and compliance workflows: Startups packaging foundation model tokens into legal compliance summaries and analysis command eye-watering premiums from law firms who bill by the hour.

- Financial analysis: Hedge funds and trading platforms gladly pay top dollar for custom-trained tokens optimized specifically for summarizing earnings reports, market sentiment, or market movements with precision.

- Healthcare decision-support: Companies offering medically validated model outputs can charge significant premiums for tokens used in clinical settings—each accurate summary or diagnostic decision has valuable human impact.

Short-term Gains, Long-term Questions

This Won’t Last Forever

The real moat isn’t just identifying the inefficiency; it’s embedding industry-specific expertise directly into the token workflow. Capturing proprietary data, training specialized smaller models, and creating tightly integrated interfaces will allow early movers to cement their advantages long after the premiums on token pricing normalize.

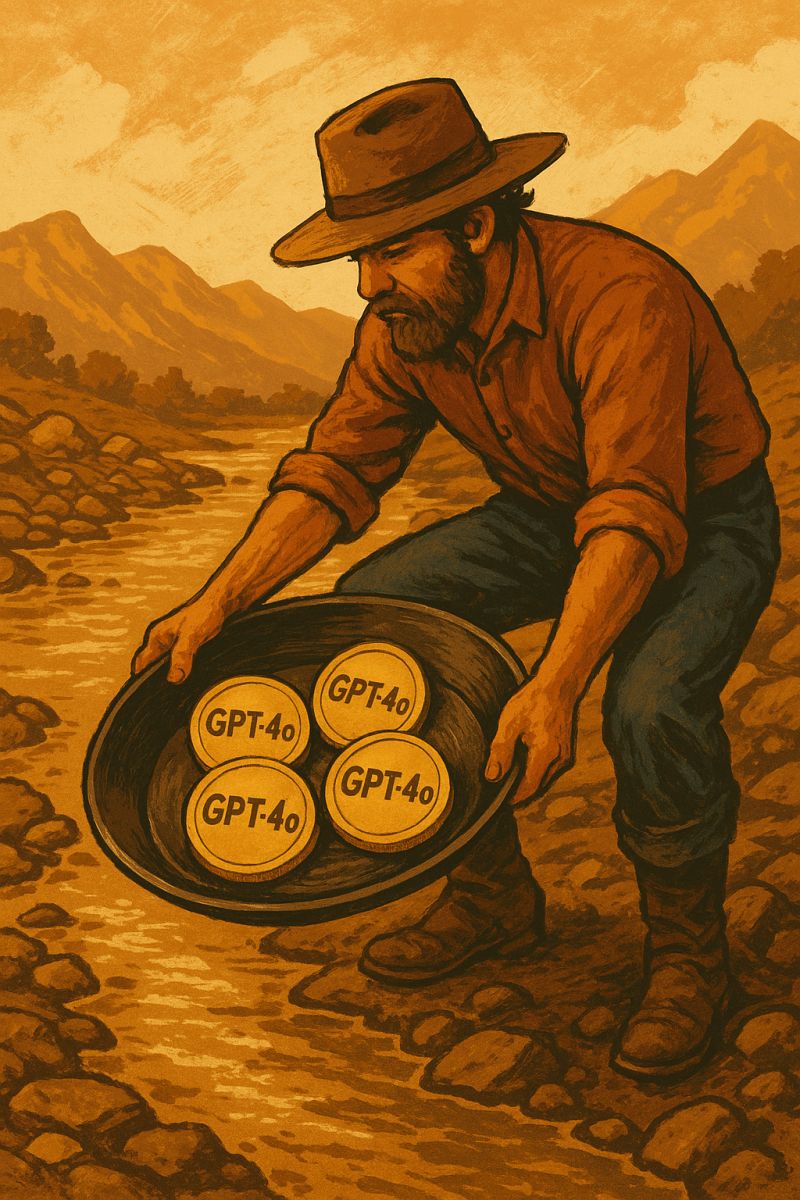

For now, we’re in the Wild West. Tokens are still underpriced commodities waiting to be repackaged into high-value assets.

In other words: it’s minting season, regardless as to whether you win in the long run.